Managing your daily drawdown is the difference between staying funded and losing your account. Most funded traders don’t fail because they lack a strategy; they fail because they miscalculate their daily loss buffer.

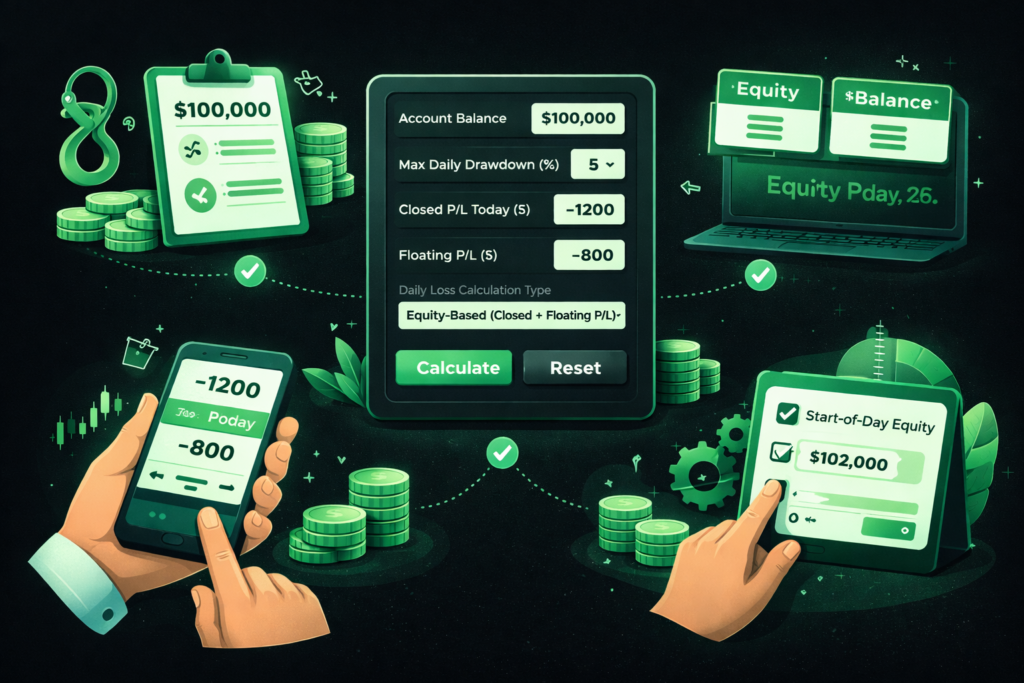

That’s exactly why we built this funded trader maximum daily drawdown calculator: It’s to give you instant clarity on where you stand before you place that next trade.

This calculator works for any prop firm, showing you your exact daily loss limit, current P/L impact, and remaining buffer in real time.

Why Daily Drawdown Matters More Than You Think

Here’s something most traders learn the hard way: your overall drawdown limit gets all the attention, but your daily drawdown is what actually kills accounts. Think about it; you could be well within your overall max loss but still breach your account if you hit your daily limit.

The brutal truth is that prop firms design daily drawdown rules specifically to filter out inconsistent traders. It’s not about punishing you; it’s about protecting their capital. Different firms calculate this differently, which is exactly why having a universal tool matters:

- Equity-based firms factor in your unrealized P/L from open positions

- Balance-based firms only count closed trades toward your daily limit

- Trailing drawdown models adjust your limit based on the start-of-day equity

- Static models keep your limit fixed regardless of account growth

Without knowing which method your firm uses and what your current numbers are, you’re essentially trading blind. One bad calculation and you’re out; no second chances, no appeals.

How to Use the Funded Trader Maximum Daily Drawdown Calculator

This isn’t your typical prop firm calculator that makes you hunt for your specific program’s rules. We built it to work for any funded trader, regardless of which firm you’re with. Here’s how to get accurate results in under 60 seconds:

Step 1: Enter Your Account Details

- Input your account balance (this is your starting capital for most firms)

- Enter your firm’s daily drawdown percentage (usually between 3-6%)

- If you’re unsure, check your evaluation rules or terms of service

Step 2: Select Your Calculation Method

This is critical. Choose between:

- Equity-Based: if your firm includes floating P/L (unrealized gains/losses count)

- Balance-Based: if only closed trades matter toward your daily limit

Step 3: Add Your P/L Numbers

- Enter your closed P/L for today (all trades you’ve already exited)

- Enter your floating P/L if applicable (current unrealized profit or loss)

- Use negative numbers for losses, positive for gains

Step 4: Advanced Options (Optional)

If your prop firm uses start-of-day trailing:

- Check the box to enable start-of-day equity mode

- Enter your account equity from when the trading day began

- This is common with firms that trail daily limits based on morning balances

Hit calculate, and you’ll instantly see four critical numbers: your daily loss limit, current day P/L, remaining buffer, and breach status. The status indicator will show you if you’re safe, approaching your limit (within 20%), or already breached.

For traders exploring different evaluation programs, understanding how each firm structures daily drawdown is essential before committing to an evaluation.

Understanding Your Results: What the Numbers Actually Mean

The calculator gives you four outputs, and each one tells you something specific about your risk position. Let’s break down exactly what you’re looking at:

Daily Loss Limit: This is your maximum allowed loss for the current trading day. It’s calculated from either your account balance or start-of-day equity multiplied by your firm’s daily drawdown percentage.

Think of this as your ceiling; once you hit it, trading stops or your account fails, depending on your firm’s rules.

Current Daily P/L: Your running total for the day.

If you selected equity-based calculation, this includes both closed trades and floating positions. If you chose balance-based, only closed trades count. The calculator shows this with a +/- sign so you can see at a glance whether you’re up or down.

Remaining Buffer: This is the number that matters most. It shows exactly how much more you can lose before hitting your daily limit.

If you’re showing profits, your buffer actually increases beyond your initial limit. If you’re down, your buffer shrinks. A zero or negative buffer means you’ve breached.

Status Indicator

- Safe means you have more than 20% of your daily limit remaining

- Approaching Limit triggers when you’re within 20% of your threshold

- Daily Drawdown Breached confirms you’ve hit or exceeded your limit

Pay special attention when you enter “approaching limit” territory. This is your warning shot. Most experienced funded traders will either close positions or avoid new trades when they hit this zone, especially late in the trading session.

Common Daily Drawdown Mistakes (And How to Avoid Them)

After watching thousands of traders use funded accounts, we’ve seen the same patterns repeat. Here are the mistakes that consistently blow accounts, and what you should do instead.

Forgetting About Floating P/L

The biggest killer for equity-based accounts. You close a losing trade, check your balance, see you’re still within limits, then open another position.

But you forget that your floating loss from the open trade counts toward your daily limit. Suddenly, you’re breached while still holding positions.

Prevention strategy:

- Always run the calculator with your current floating P/L included

- Before entering any new position, calculate your worst-case scenario

- If you’re anywhere near your limit, consider sitting out until tomorrow

Miscalculating the Server Reset Time

Your local time might be 11 PM, but if your prop firm’s server resets at midnight GMT, you’re technically trading tomorrow’s session. Losses you think are splitting across two days might actually be stacking on one day.

Prevention strategy:

- Find your firm’s exact server reset time in their FAQ or support docs

- Set an alarm 30 minutes before reset if you trade near that window

- When in doubt, close positions before the reset to start fresh

Not Accounting for Commissions and Fees

That $500 loss? It’s actually $530 after commissions eat into it. On high-frequency trading days, these fees stack up and push you closer to your limit faster than expected.

Prevention strategy:

- Add a 5-10% buffer to your daily limit calculations to account for fees

- Track your average commission per round trip and factor it into position sizing

- Use the calculator before every trade, not just at the start of the day

Revenge Trading After a Loss

You hit a losing streak and decide to “make it back” before the end of the day. This is how a manageable loss becomes a blown account. The daily drawdown exists specifically to stop this behavior.

Mastering trading discipline is what separates consistently profitable traders from those who blow accounts.

Prevention strategy:

- Set a personal daily loss limit at 50-70% of your firm’s official limit

- If you hit your personal threshold, stop trading regardless of time left

- Remember that one bad day isn’t the end of your trading journey

Ignoring the Trailing Mechanism

If your firm uses start-of-day trailing, your limit moves up as you profit, but never moves down. Traders forget this and give back profits without realizing their drawdown threshold has risen.

You might have started the day with a $5,000 limit, but now it’s $5,800 because you peaked at +$800. If you give that profit back, you’re not back to neutral; you’re approaching breach.

Prevention strategy:

- Use the advanced “start-of-day equity” option in our calculator

- Check your threshold after every winning trade during high volatility

- Consider locking in profits more aggressively when your limit is trailing

When to Check Your Daily Drawdown (and When Not To)

Timing matters. Checking too often creates anxiety and overtrading. Checking too rarely leads to breaches. Here’s the balanced approach that works for most funded traders:

Critical Checkpoints (Always Check)

These are the non-negotiable moments when you must run the calculator every time:

Before Market Open:

- Run the calculator with zero P/L to see your starting limit for the day

- This sets your mental framework and position sizing for the session ahead

- Takes 30 seconds and prevents major mistakes later, especially for instant funding programs

Before Entering High-Risk Trades:

- Update your numbers if you’re planning a news trade, scaling in during volatility, or taking larger-than-usual positions

- You need to know your exact buffer before taking on additional risk

- This is non-negotiable for trades with wider stop losses

After Any Significant Loss:

- Took a substantial hit on a trade? Update the calculator immediately

- Don’t assume you know where you stand; confirm it with current numbers

- Define “significant” as any loss over 30% of your daily limit

What to Avoid (Stop Over-Checking)

Obsessive monitoring does more harm than good; here’s when to step back completely:

Don’t Check During Every Minor Fluctuation:

If you’re running the calculator every 5 minutes, you’re not trading; you’re anxiety-managing. Set specific checkpoints (morning, mid-day, before close) rather than constant monitoring. Trust your pre-trade calculations and focus on execution.

Special Considerations for Swing Traders:

For swing traders holding multi-day positions, the calculation gets trickier. Your floating P/L from yesterday’s open positions rolls into today’s daily drawdown calculation. Make sure you account for overnight moves when you check in each morning. Weekend gaps can push you closer to your limit before you even place a new trade.

Protect Your Funded Account By Managing Your Buffer

Your funded account isn’t lost because of bad trades; it’s lost because of mismanaged daily drawdown. By understanding how your firm calculates losses, tracking closed and floating P/L, and knowing your exact remaining buffer, you remove guesswork from every decision.

Use the calculator before markets open, after losses, and before high-risk trades to stay in control. When you manage your buffer proactively, you trade with discipline, avoid preventable breaches, and give yourself the best chance to stay funded long term.

Our Latest Stories

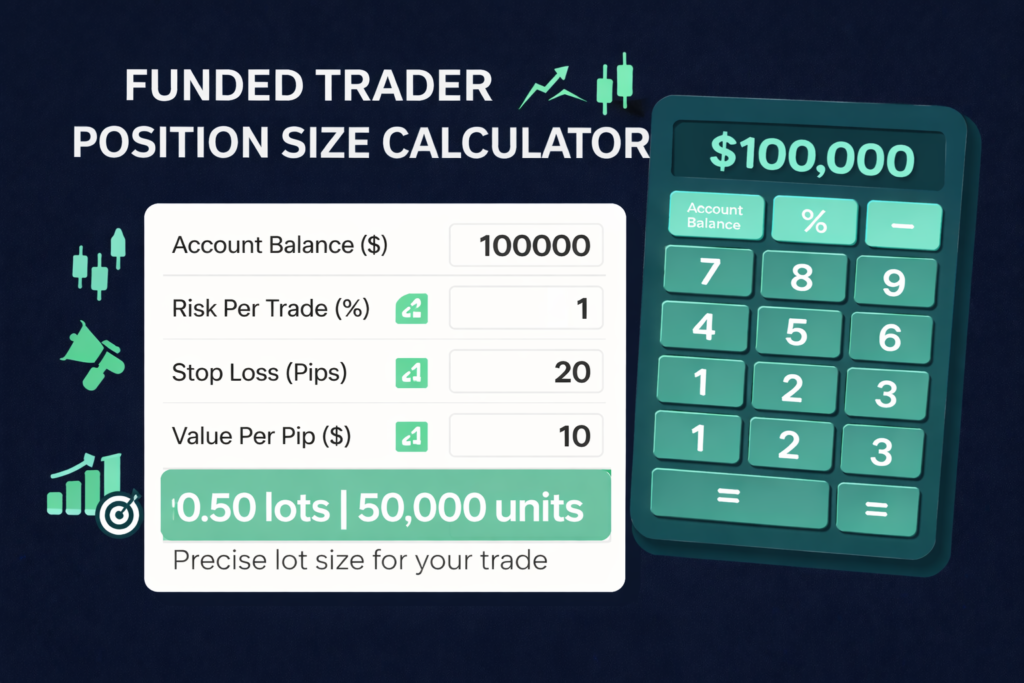

Funded Trader Position Size Calculator: Turn Risk Per Trade Into Exact Lots in Seconds

Position sizing isn’t just another trading calculation; it’s the math that determines…

How To Get A Funded Gold Trading Account: A Clear Path for Trading Gold Without Personal Capital

Gold is one of the most actively traded assets in the world,…

When Does the Daily Loss Limit Reset in Prop Firm Accounts: Exact Reset Times Traders Must Know

Many prop traders follow every rule yet still lose accounts due to…

Stay Informed,

Stay Ahead

Bookmark this blog to keep your edge sharp. Whether you're prepping for your first challenge or scaling into a six-figure funded account, our insights are here to help.