Gold is one of the most actively traded assets in the world, with the XAUUSD market operating almost 24 hours a day during the trading week. Yet most traders never trade it with meaningful capital because of risk constraints.

This guide explains the process of getting a funded gold trading account step-by-step. We’ll focus on structure, discipline, and rule-based evaluation, not shortcuts or unrealistic promises. So, let’s dive in.

Your Path to Funded Gold Trading: 7 Steps to Start Trading With Capital

Getting funded to trade gold doesn’t require massive personal capital or years of experience. The path is straightforward: prove your discipline through an evaluation, and you’ll gain access to simulated trading capital to trade gold, metals, and other markets.

This opportunity exists because prop firms recognize that talent and consistency matter more than personal wealth. Here’s exactly how to get started.

Step 1: Research Prop Firms Offering Gold and Metals Trading

Your first task is to identify a proprietary trading firm that supports the markets you want to trade. Not all prop firms offer gold or precious metals, so this step is critical.

Look for firms that provide:

- Gold, silver, and other precious metals

- Complementary markets like forex, indices, and commodities

- Professional trading platforms like cTrader for reliable execution

- Clear rule structures and transparent payout terms

Pro Tip: Focus on firms that clearly state their available instruments on their website. If gold isn’t explicitly mentioned in their tradable assets, move on. You want a firm where metals trading is a core offering, not an afterthought.

Step 2: Choose Your Evaluation Model

Prop firms offer different challenge structures, and selecting the right one depends on your experience level and trading style.

Common evaluation models include:

- Instant funding – No evaluation required; you start trading immediately with a simulated funded account

- 1-step evaluation – Single phase to prove consistency before getting funded

- 2-step evaluation – Two phases with progressive profit targets and risk management tests

- 3-step evaluation – Extended evaluation for traders who prefer gradual progression

Each model has different requirements. Instant funding (often using instant-trailing drawdown) typically costs more upfront, but suits experienced traders who want immediate access.

Multi-step evaluations are more affordable and give you time to demonstrate consistent risk management across multiple phases.

Example: If you’re transitioning from personal trading and already have a proven gold strategy, instant funding eliminates the waiting period. If you’re newer to prop trading, a 2-step or 3-step evaluation gives you structure and checkpoints to refine your approach.

Step 3: Select Account Size and Drawdown Type

Account size determines your profit potential, while drawdown type affects how you manage risk during the evaluation.

Account sizes typically range from:

- $10,000 entry-level accounts

- $25,000 – $50,000 mid-tier accounts

- $100,000+ advanced accounts

Drawdown types to understand:

- Trailing drawdown – Your maximum loss limit moves upward as your equity grows, rewarding profitable trading

- Static drawdown – Fixed loss limit from your starting balance, regardless of profits earned

- Instant-trailing – Used in instant funding programs, combining immediate access with dynamic risk management

Trailing drawdowns offer more flexibility for traders who build equity steadily. Static drawdowns provide clearer, unchanging risk boundaries, ideal for traders who prefer absolute clarity on their risk limits. Instant-trailing combines the benefits of immediate funding with adaptive drawdown management.

Pro Tip: Start with a smaller account size during your first evaluation. You can always scale up after you’re funded. The evaluation rules are identical across account sizes, so there’s no advantage to starting large if you’re still learning the firm’s requirements.

Additionally, some firms offer multiple challenge options with different drawdown structures, such as programs with static drawdown for steady risk control, trailing drawdown for dynamic growth, or instant-trailing for immediate funding with adaptive risk management.

Step 4: Complete Registration and KYC Requirements

Once you’ve selected your challenge, you’ll need to complete registration and verification.

Standard requirements include:

- Valid government-issued ID (passport or driver’s license)

- Proof of address (utility bill or bank statement)

- Email verification

- Agreement to the terms of service

Most firms activate your account within 24-48 hours after KYC approval. Some instant funding programs activate even faster, allowing you to begin trading almost immediately after verification.

Important: Use accurate information during registration. Any discrepancies between your trading account name and payout details can delay withdrawals later.

Step 5: Pass Evaluation Phases

This is where you demonstrate your trading skill and discipline. Evaluation phases have specific profit targets and risk limits you must follow.

Typical requirements include:

- Profit targets (commonly 8-10% for Phase 1, 5% for Phase 2)

- Maximum daily loss limits (usually 5% of starting balance)

- Maximum total drawdown (typically 10% trailing or static)

- Minimum trading days (often 5 days per phase)

Your goal isn’t to trade aggressively; it’s to prove consistency. Firms fund traders who follow rules, manage risk, and generate steady returns. One lucky trade doesn’t get you funded; a pattern of disciplined execution does.

Example: If you’re trading a $50,000 evaluation with a 10% Phase 1 target, you need $5,000 in profit while never exceeding your daily or total drawdown.

Spreading this across 10-15 trading days with $300-$500 daily targets is far safer than trying to hit it in 5 days with $1,000 daily goals.

Step 6: Receive Your Simulated Funded Account and Begin Trading

After successfully completing your evaluation phases, you’ll receive access to a simulated funded account. This account operates under similar conditions to the evaluation, but now you’re trading for actual profit splits.

What changes after funding:

- You keep up to 90% of your simulated profits

- You continue following the same risk management rules

- Traders who consistently follow rules and manage risk may be eligible for account scaling

- You can request payouts on a regular schedule

The transition from evaluation to funded trading should feel seamless. You’re using the same platform, the same risk rules, and ideally the same strategy that got you funded in the first place.

Pro Tip: Don’t change your trading approach just because you’re now funded. The discipline and consistency that passed your evaluation are the same qualities that will keep you profitable long-term.

Step 7: Request Payouts After Meeting Minimum Requirements

Most prop firms allow payouts on a bi-weekly schedule, with some offering weekly payouts as an add-on feature for traders who want more frequent access to their earnings.

Common payout requirements include:

- Minimum time period (typically 14 calendar days from funding)

- Minimum trading days (usually 5 days of active trading)

- Profit threshold (some firms require a minimum profit amount)

Payment methods typically include:

- Bank transfer (ACH or wire)

- Cryptocurrency (Bitcoin, USDT, Ethereum)

- Other electronic payment systems

After your first successful payout, the process becomes routine. Many funded traders establish a rhythm: trade consistently, hit your targets, request withdrawals, and repeat.

Important: Remember that your funded account represents simulated capital, not a personal bank account. You’re managing the firm’s demo account under professional conditions, and your skill is what generates your income, not luck or high-risk gambling.

Getting a funded gold trading account is a merit-based opportunity accessible to any trader willing to demonstrate discipline and consistency. You don’t need tens of thousands of dollars in personal capital, just a solid strategy, proper risk management, and the patience to follow the process.

Whether you choose instant funding to start immediately, or prefer a structured 1-step, 2-step, or 3-step evaluation to build confidence, the path to funded trading is clearer and more accessible than ever before.

Your Funded Trading Journey: What Happens After You Get Funded

Receiving your funded account is an achievement, but it’s just the beginning of your professional trading journey. Understanding what comes next helps you build long-term consistency and maximize the opportunity you’ve earned through discipline and skill.

Here’s what your life as a funded gold trader looks like.

Your Daily Trading Routine on a Funded Account

Your trading routine doesn’t dramatically change after funding; it should feel familiar. You’re using the same cTrader platform, following the same risk rules, and ideally executing the same strategy that passed your evaluation.

Key differences you’ll notice:

- Real profit potential: Your gains now translate to actual payouts

- Continued accountability: You still follow drawdown limits and risk parameters

- Performance tracking: Your consistency determines your long-term success

Most successful funded traders establish a structured routine: analyze markets during preferred sessions (Asian for lower volatility, London-NY overlap for volume), execute planned trades within risk limits, and maintain detailed journals to track what’s working.

Important: The transition from evaluation to funded trading tests your psychological discipline. Many traders feel pressure to perform differently, but your job remains the same: follow your proven process.

Performance Expectations to Stay Funded

Maintaining your funded account requires the same discipline that earned it. You’re not expected to profit every day or every week, but you must continue respecting risk management rules.

Core expectations include:

- Staying within maximum drawdown limits (trailing or static, depending on your program)

- Following daily loss limits to protect capital

- Maintaining trading activity (typically, minimum trading days per cycle)

- Adhering to platform and instrument rules

Think of these rules as guardrails, not obstacles. They exist because professional trading prioritizes capital preservation over aggressive gains. Firms fund traders who demonstrate this understanding consistently.

If you experience a drawdown, don’t panic. Losing periods happen to every trader. The key is managing them within the allowed parameters and avoiding the emotional mistakes that lead to rule violations.

How Account Scaling Works

One of the most motivating aspects of funded trading is the scaling opportunity. Traders who consistently follow rules and manage risk may be eligible for account scaling, allowing them to trade larger capital and increase their profit potential.

Scaling typically works like this:

- Meet specific performance criteria over time

- Demonstrate consistent risk management

- Maintain strong adherence to trading rules

- Request scaling evaluation or automatic upgrades (firm-dependent)

Some programs offer quarterly or milestone-based scaling, while others review performance on a case-by-case basis. The exact process varies by firm, but the principle remains constant: consistency and rule-following unlock growth.

Remember that scaling isn’t about proving you can make bigger gains; it’s about proving you can manage larger capital with the same discipline you’ve already shown.

Dealing With Losing Periods While Funded

Every funded trader experiences losing days, weeks, or even months. The difference between traders who survive and those who don’t is how they respond.

When facing losses:

- Reduce position size if you’re approaching drawdown limits

- Take a break if emotional control becomes difficult

- Review your journal to identify if you’re deviating from your plan

- Stick to your strategy instead of revenge trading or forcing setups

Your funded account represents simulated capital, not personal savings. This should reduce emotional pressure, but many traders still feel performance anxiety. Combat this by focusing on process over outcomes; if you execute your plan correctly, results follow over time.

The traders who maintain funding long-term are those who treat losing periods as normal parts of trading rather than catastrophic failures.

Payout Patterns and Financial Planning

Most funded traders request payouts on a bi-weekly schedule, with some firms offering weekly payouts as an add-on feature for those who want more frequent access to earnings.

Typical payout cycle:

- Complete minimum trading days (usually 5 days of activity)

- Wait for the minimum time period (typically 14 calendar days from funding)

- Request withdrawal through your dashboard

- Receive payment via bank transfer, cryptocurrency, or other methods

Financial planning tip: Many successful traders withdraw a portion of profits regularly while leaving some gains in the account to cushion against future drawdowns. This creates a sustainable income pattern without depleting your trading buffer.

Track your performance across multiple payout cycles to understand your average returns. This helps with personal budgeting and keeps expectations realistic: trading income fluctuates, and planning accordingly prevents financial stress.

Your funded account proves that talent matters more than capital. Success comes from discipline, continuous improvement, and commitment to your proven process.

Funded Gold Trading Works When Decisions Stay Rule-Driven

Getting a funded gold trading account isn’t about shortcuts or aggressive bets; it’s about following a structured process, choosing the right evaluation path, and managing risk with discipline.

From selecting a suitable challenge to staying funded and withdrawing profits, every stage rewards traders who respect rules and remain consistent. If you want to trade gold without risking large personal capital and grow through merit, the opportunity is clear.

Start your funded trading journey with us at Eleonex, where structured evaluations, fair rules, and professional support are built to help disciplined traders progress with confidence.

Our Latest Stories

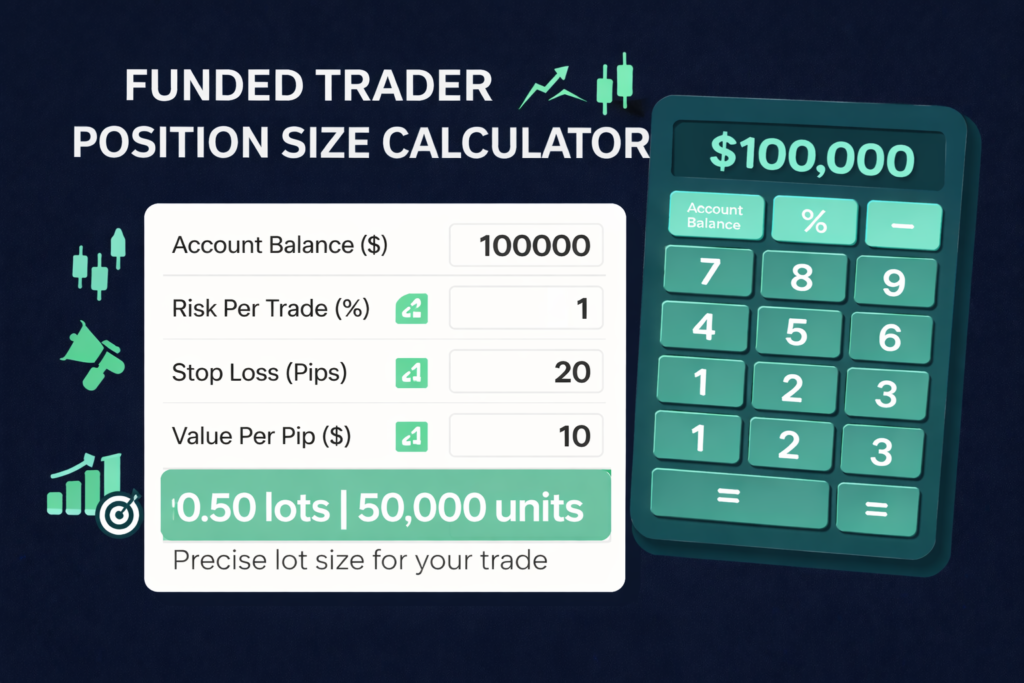

Funded Trader Position Size Calculator: Turn Risk Per Trade Into Exact Lots in Seconds

Position sizing isn’t just another trading calculation; it’s the math that determines…

Funded Trader Maximum Daily Drawdown Calculator: Know Your Breach Point Before the Market Tests You

Managing your daily drawdown is the difference between staying funded and losing…

When Does the Daily Loss Limit Reset in Prop Firm Accounts: Exact Reset Times Traders Must Know

Many prop traders follow every rule yet still lose accounts due to…

Stay Informed,

Stay Ahead

Bookmark this blog to keep your edge sharp. Whether you're prepping for your first challenge or scaling into a six-figure funded account, our insights are here to help.