Many prop traders follow every rule yet still lose accounts due to timing misunderstandings rather than poor execution. Reset mechanics quietly influence risk windows, overnight exposure, and even profitable sessions.

That’s why knowing the exact moment the daily loss limit resets in prop firm accounts is critical. This article clarifies how reset logic works behind the scenes and why a single overlooked detail can invalidate an otherwise disciplined trading day.

Daily Loss Limit Reset Times: When Your Trading Day Starts Fresh

The timing of your daily loss limit reset directly impacts how you manage risk, hold positions, and plan your trading sessions. Understanding when your counter resets to zero is critical for avoiding violations.

Two primary reset patterns dominate the prop trading industry, and your firm’s approach determines everything from position management to timezone considerations.

Reset Pattern 1: Midnight Server Time (00:00)

The midnight reset is the most widely adopted approach across prop firms globally. Your daily loss limit resets at 00:00 (midnight) according to the broker’s server timezone, not your local time.

Firms using midnight reset:

- FTMO: 00:00 CE(S)T (Central European Time – UTC+1 winter, UTC+2 summer)

- E8 Funding: 00:00 server time for Forex accounts

- FundedNext: 00:00 server time (GMT+2 winter, GMT+3 summer)

- Alpha Capital Group: 00:00 MT5 Server Time (GMT+2 winter, GMT+3 summer)

- Eleonex: 00:00 UTC across Ignite (instant-trailing), Pulse (trailing), and Forge (static) programs

- Blue Guardian: 00:00 EST

- Funding Pips: 00:00 UTC

Disclaimer: Reset times may change. Always confirm the latest reset rules with your firm’s official documentation or support team.

How the midnight reset works: At the stroke of midnight, according to server timezone, your daily loss counter returns to zero.

Profits or losses from yesterday no longer affect today’s allowance. Your new daily limit recalculates based on either your initial balance (static method) or current balance (dynamic method), depending on your firm’s structure.

Critical timezone consideration: “Midnight” occurs at vastly different local times depending on where you trade. FTMO’s midnight CET happens at 6 PM EST in New York, 7 AM SGT in Singapore, and 10 AM AEDT in Sydney.

If you’re trading from Asia or Australia, your reset happens during active market hours, not overnight.

Reset Pattern 2: End of Trading Day (5:00 PM EST / 17:00 EST)

This approach aligns with the New York forex session close, which traditionally marks the end of the global trading day. The reset occurs at 5:00 PM Eastern Time or an equivalent end-of-day snapshot moment.

Firms using NY close reset:

- MyForexFunds: 17:00 (5 PM) EST – daily loss limit resets based on starting equity or balance at 5 PM EST

- The5%ers: 23:59 MT5 Server Time (captures end-of-day equity/balance snapshot)

- Funded Trading Plus: 16:59 EST (calculates daily drawdown from this snapshot)

- Prop Number One: 17:00 (5 PM) EST

- City Traders Imperium: 17:00 EST

- Goat Funded Trader: 17:00 EST for certain 2-Step models

How the NY close reset works: These firms take an account snapshot at day’s end rather than calendar midnight. Your daily loss limit resets based on your balance and equity at this specific moment. This structure mirrors traditional forex market mechanics, where the NY close represents the completion of the 24-hour forex cycle.

Advantage for swing traders: If you hold overnight positions, this reset timing happens during your active trading hours (if you’re US-based) rather than during sleep hours. You can actively manage positions around the reset rather than waking up to a new trading day mid-session.

Special Case: No Daily Loss Limit

Some firms eliminate daily loss caps entirely and rely solely on overall account drawdown limits that trail your equity high-water mark.

Firms without traditional daily loss limits:

- Apex Trader Funding: No daily loss limit; uses only trailing drawdown threshold

- FundedNext Stellar Instant: No daily loss cap in some models; uses trailing maximum loss

How no-daily-limit models work: You can theoretically lose any amount in a single trading session as long as you don’t breach your total account drawdown threshold. There’s no daily reset because there’s no daily limit to reset, only one continuous maximum loss measurement.

Risk consideration: Without a daily limit forcing you to pause after bad sessions, one catastrophic day can permanently end your account. This structure rewards traders with exceptional discipline but punishes emotional decision-making severely.

The barrier between funded and failed becomes your overall drawdown, not a daily speed bump.

Why Reset Times Matter for Risk Management

Understanding your reset timing affects floating loss calculations and position management around critical windows.

The reset window challenge: Open positions with unrealized losses count toward TODAY’s daily limit until the exact moment of reset. At reset, your counter returns to zero, but your open positions remain unchanged with the same floating P&L.

Example scenario (FTMO – midnight CET reset):

- Daily loss limit: $5,000 (5% of $100,000 account)

- Current time: 11:30 PM CET (30 minutes before reset)

- Closed losses today: $3,000

- Open position floating loss: $2,500

- Total current loss: $5,500

Outcome: Violation occurs immediately. Even though midnight is 30 minutes away and would reset your limit, the rule breach already happened when equity dropped below $95,000. The account disables before the reset occurs; those 30 minutes don’t save you.

Pro tip: Never trade within one hour of reset time if you’re approaching your daily limit. Platform lag, slippage, and unexpected swap charges can push you over the threshold in the final minutes.

How to Verify YOUR Specific Reset Time

Finding your exact reset time requires checking multiple sources since firms don’t always prominently display this information.

Step 1 – Check your trading dashboard:

- MetaTrader 4/5: Look for “Today’s Permitted Loss” or “Daily Loss Limit” indicator

- The platform displays the server time in the bottom-right corner

- Note whether it shows EST, UTC, GMT+2, or generic “server time”

- Watch if the daily loss counter resets at midnight server time

Step 2 – Review account documentation:

- An email confirmation will be sent after purchasing your challenge

- Challenge rules PDF available in your account portal

- Terms & Conditions section covering drawdown and reset rules

- FAQ section on the firm’s website (search “daily loss reset”)

Step 3 – Contact support for written confirmation:

Ask specifically: “At what exact time (including timezone) does my daily loss limit reset? Does this time change during Daylight Saving Time transitions?”

Written confirmation protects you from misunderstandings and provides documentation if disputes arise.

Step 4 – Test observation method:

- Monitor your “daily loss” metric approaching the suspected reset time

- Watch whether it resets to $0 at that exact moment

- Document the precise reset time for future reference

- Only test this on profitable days to avoid risking violations

Example email template:

“Hi [Firm] Support,

I’m trading account #[number]. Can you confirm the exact time my daily loss limit resets, including the timezone (EST, UTC, server time, etc.)? Also, does this change during Daylight Saving Time transitions?

Thank you.”

Confirming your reset time eliminates guesswork and helps you trade confidently within your firm’s rules without unexpected violations.

What Actually Counts Toward Your Daily Loss? Equity vs Balance Explained

Knowing when your daily loss limit resets is only half the battle. The bigger problem? Understanding what actually counts toward that limit. This is the number one reason traders still get breached despite knowing their exact reset time.

The difference between equity-based and balance-based calculations determines whether your open positions can silently push you into violation territory.

Understanding Daily Loss Calculation Methods

Prop firms use two main approaches to calculate daily losses, though one dominates the industry.

Equity-Based Daily Loss (Industry Standard)

Equity-based calculation includes everything happening in your account right now, both closed trades and floating profits or losses from open positions.

What counts toward your daily loss:

- All closed trades (winners and losers)

- Floating P&L from open positions (unrealized gains/losses)

- Commission fees on all trades

- Swap/financing charges (overnight holding costs)

- Spreads are paid on entries and exits

How it works in practice: If your account started the day at $100,000 with a 5% daily loss limit ($5,000), and you’ve closed $2,000 in losses while holding an open position with a floating $3,500 loss, your total daily loss is $5,500. You’ve already hit your daily loss limit. Your account will be locked or restricted, even though you haven’t closed that losing trade yet.

Firms using equity-based calculation: FTMO, FundedNext, E8 Funding, Alpha Capital Group, The5%ers, and most major prop firms in 2025.

Balance-Based Daily Loss (Extremely Rare)

Balance-based calculation primarily counts closed trades, though implementations vary significantly by firm. Some firms use “balance or equity, whichever is higher” at specific snapshot times.

What typically counts:

- Closed trades (realized P&L)

- Commission on closed trades

- Swap fees from closed positions

- May or may not include floating losses, depending on the firm

Important note: Pure balance-based models (ignoring floating losses entirely) are extremely rare in 2025. Most firms claiming “balance-based” still incorporate equity considerations at end-of-day snapshots or during breach calculations.

Why it’s rarer: Models that ignore floating losses allow traders to hold large unrealized losses without immediate consequences, which increases risk exposure for prop firms. The industry has largely moved toward equity-based tracking for tighter real-time risk control.

The Hidden Costs: Commissions, Spreads, and Swaps

Many traders forget that trading costs eat into their daily loss allowance just like losing trades.

Are These Included in Daily Loss Calculations?

Commission fees: ✅ Always included in both equity and balance-based models

- Charged per lot/contract traded

- Deducted immediately from account equity

- Example: 10 round-turn trades at $7 commission = $70 toward daily loss

Spreads: ✅ Always included (implicit cost)

- Built into entry/exit prices

- Not shown separately, but affects P&L

- Wider spreads = higher effective loss

Swap/Financing fees: ✅ Usually included

- Charged for holding positions overnight

- Applied at rollover time (typically 5 PM EST or midnight)

- Can be positive (credit) or negative (debit)

- Check your firm’s specific rules; most include swaps in daily loss

Pro tip: If you’re trading close to your daily limit, account for trading costs before opening new positions. A $4,800 loss on a $5,000 limit might look safe, but two more trades at $7 commission each could push you over.

Quick Decision Rules: If Equity-Based, Then…

Most prop firms use equity-based daily loss calculations. Here’s how to trade safely under this model:

Rule 1: Never ignore floating losses → That open position showing $1,200 floating loss? It counts right now, not when you close it.

Rule 2: Calculate total exposure before every trade → Formula: Closed losses today + Current floating P&L + Trading costs = Total daily loss used

Rule 3: Close losing positions before they compound → Holding an $800 loser while opening new trades multiplies your risk exposure

Rule 4: Reduce position size as daily loss increases → At 50% of daily limit: Cut position size by half → At 75% of daily limit: Take only highest-conviction setups → At 90% of daily limit: Stop trading for the day

Rule 5: Check equity constantly when holding multiple positions → Three small losing trades can add up faster than you realize → Use platform equity display, not balance

Real Example: Why Equity-Based Catches Traders Off Guard

Trader scenario:

- Account: $100,000 (5% daily loss limit = $5,000)

- Morning: Closed two trades for $1,500 total loss

- Afternoon: Opens swing trade, currently showing $2,800 floating loss

- Current total daily loss: $1,500 + $2,800 = $4,300

- Remaining allowance: Only $700

What happens next: The trader thinks, “I only lost $1,500 in closed trades, I have $3,500 left.” They open another position risking $1,000. That new position drops $800 immediately.

New calculation: $1,500 closed + $2,800 floating (first trade) + $800 floating (second trade) = $5,100

Result: Account breached and disabled. The trader didn’t realize floating losses were being counted in real-time.

To avoid miscalculations like this, use a funded trader maximum daily drawdown calculator to track your exact remaining allowance in real-time.

How to Verify Your Firm’s Calculation Method

Not sure if your prop firm uses equity or balance-based calculations? Here’s how to confirm:

Check your dashboard during a live trade:

- Open a small test position

- Let it go into a floating loss (even just $50)

- Watch your “daily loss” or “drawdown” indicator

- If it increases immediately → Equity-based

- If it stays unchanged → Balance-based (or end-of-day snapshot)

Review your firm’s rules documentation:

- Search for “equity” or “floating” in your terms

- Look for phrases like “including open positions” (equity-based)

- Contact support: “Does my daily loss include unrealized P&L from open trades?”

Why verification matters: Understanding your firm’s calculation method helps you manage positions carefully and avoid unexpected violations. When in doubt, always trade as if floating losses count immediately; this approach keeps you safe regardless of the model.

Understanding what counts toward your daily loss transforms how you manage risk. Skilled traders monitor their equity constantly, account for all costs, and never assume they have more room than they actually do.

This discipline separates funded traders from those who repeatedly breach their accounts.

Make Daily Loss Resets Part Of Your Trading Discipline

Daily loss limits don’t just test strategy; they test timing awareness and risk discipline. Traders who pass prop firm challenges know exactly when their limits reset, how equity is measured, and when to step aside before rules override skill.

By aligning your trading schedule with reset windows, monitoring floating losses in real time, and verifying firm-specific rules, you remove the most common cause of avoidable breaches.

Treat reset mechanics as a core part of your routine, not a technical footnote, and your account longevity improves immediately.

Our Latest Stories

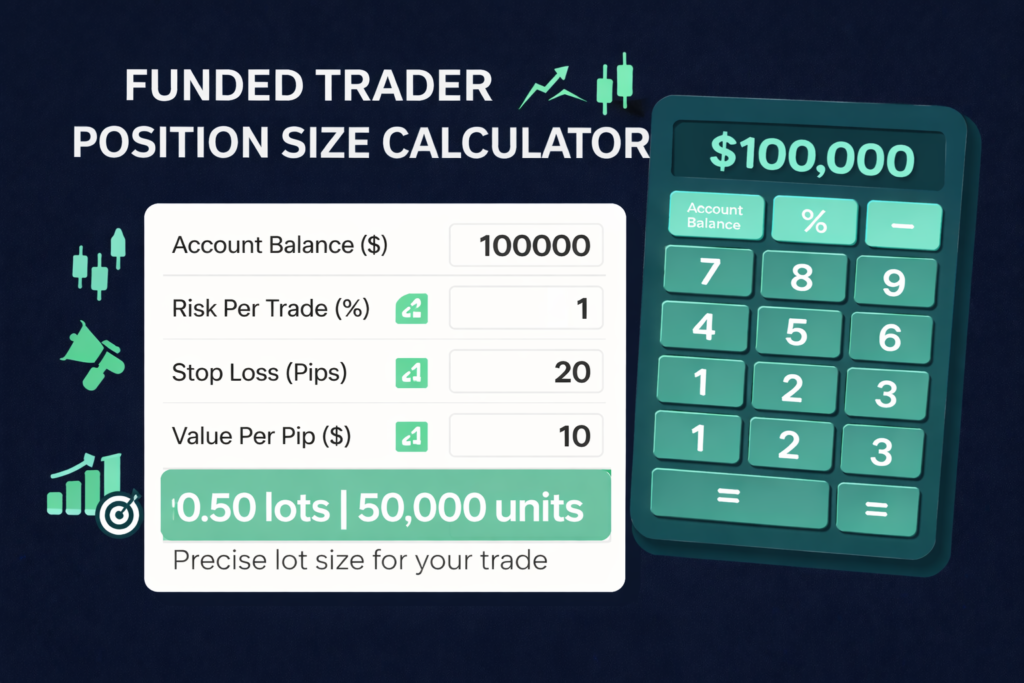

Funded Trader Position Size Calculator: Turn Risk Per Trade Into Exact Lots in Seconds

Position sizing isn’t just another trading calculation; it’s the math that determines…

Funded Trader Maximum Daily Drawdown Calculator: Know Your Breach Point Before the Market Tests You

Managing your daily drawdown is the difference between staying funded and losing…

How To Get A Funded Gold Trading Account: A Clear Path for Trading Gold Without Personal Capital

Gold is one of the most actively traded assets in the world,…

Stay Informed,

Stay Ahead

Bookmark this blog to keep your edge sharp. Whether you're prepping for your first challenge or scaling into a six-figure funded account, our insights are here to help.