How Long Does It Take to Get a Funded Account: Timelines Explained for Every Trader Type

The journey to becoming a funded trader rarely unfolds the way people expect. Some move quickly, others stall, and almost everyone discovers blind spots they didn’t know they had.

That’s why the question of how long it takes to get a funded account carries so much weight; it hints at an answer shaped less by time and more by personal readiness.

From Challenge to Capital: Your Realistic Timeline to Getting Funded

Getting a funded prop trading firm account takes between 5 trading days and 8 weeks from the moment you purchase an evaluation challenge to receiving access to your funded account.

The exact timeline depends on your evaluation type, trading style, and how well you navigate the challenge requirements.

Understanding where you fall on this spectrum helps you set realistic expectations and plan your path to funding.

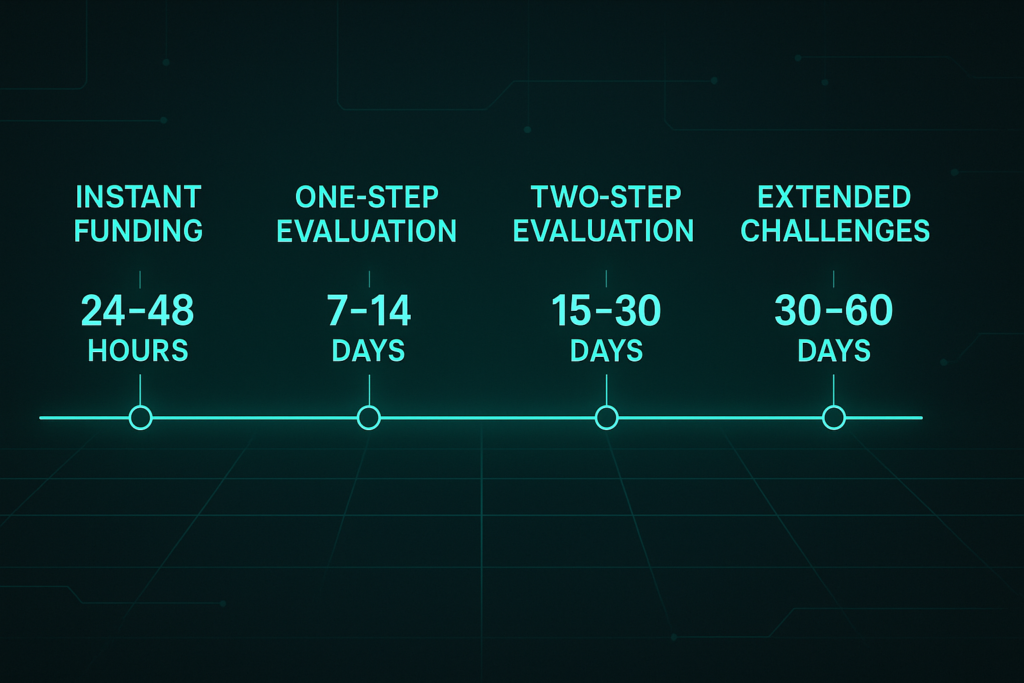

Timeline Breakdown by Evaluation Type

Different challenge structures serve different trader profiles. Here’s what to expect:

Instant funding programs: 24-48 hours

- Fastest path to funded capital

- Account access within a day or two after verification

- Best for experienced traders comfortable with immediate, tighter rules

One-step evaluations: 7-14 calendar days

- Minimum 5 trading days required

- Additional 2-3 days for verification and setup

- Ideal for confident traders who prefer a single focused challenge

Two-step evaluations: 15-30 calendar days

- At least 10 trading days across both phases

- Graduated approach with two separate profit targets

- Benefits traders who want to demonstrate consistency in stages

Extended challenges: 30-60 calendar days

- Time-based programs (monthly or bi-monthly)

- Perfect for swing traders needing flexibility

- Still requires a minimum of trading days within the window

What Most Traders Actually Experience

The minimum timelines above represent ideal scenarios. In reality, most traders take 4-8 weeks to secure funding when you account for:

- Learning the specific rules of their chosen evaluation

- Failed attempts and retakes (average trader needs 2-3 attempts)

- Verification and account setup time (1-5 business days)

- Conservative trading approach to meet consistency requirements

Failed attempts are completely normal. This isn’t about trading skill; it’s about adapting your profitable strategy to work within prop firm constraints. Each attempt teaches you valuable lessons about rule compliance and risk management.

Having your KYC documents ready in advance speeds up the verification phase considerably. A conservative trading approach naturally extends your timeline, but it dramatically increases your success probability.

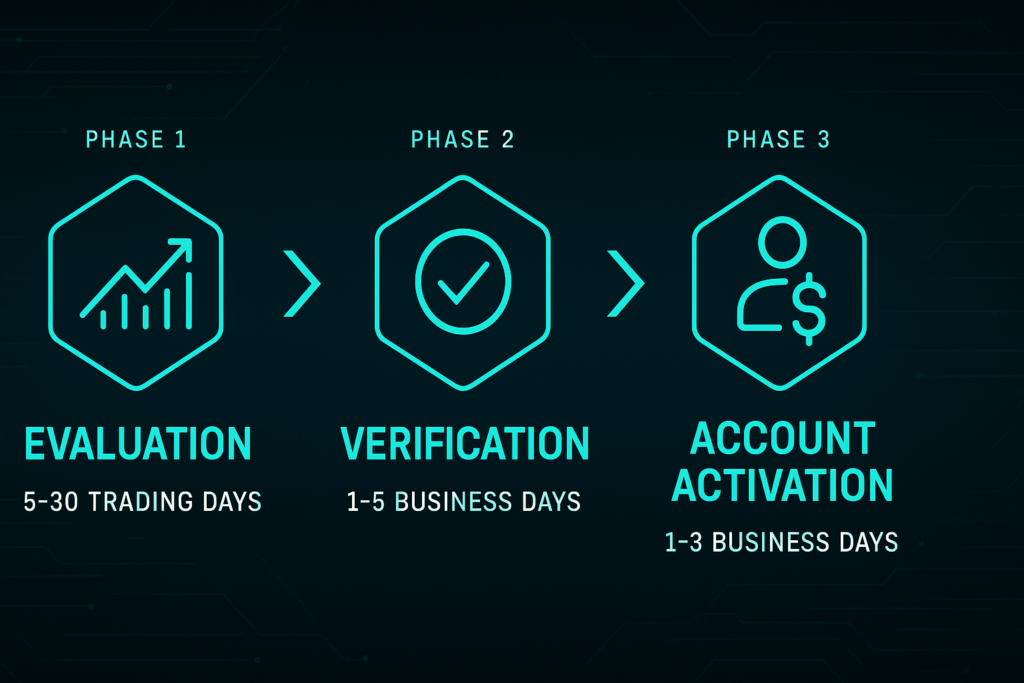

The Three Phases Every Trader Goes Through

Understanding the complete journey from challenge purchase to funded account helps you plan effectively and avoid surprises:

Phase 1: Evaluation (5-30 trading days)

This is where you prove your strategy works within the firm’s parameters. You’re demonstrating profit generation while respecting risk limits, exactly what you’ll do with funded capital.

Phase 2: Verification (1-5 business days)

After passing, you’ll submit KYC documents for identity verification and sign your funded trader agreement. Most traders complete this within 3-4 business days if documentation is prepared.

Phase 3: Account Activation (1-3 business days)

The firm sets up your live trading account and delivers credentials. Once you receive login details, you’re officially a funded trader with access to capital.

Timeline Expectations by Trader Profile

Your experience level significantly impacts how quickly you’ll secure funding:

Experienced traders: 10-12 calendar days

- 5-7 trading days to meet profit targets

- 3-5 days for verification and setup

- Already understand risk management within structured parameters

First-time prop firm traders: 6-8 weeks

- Includes one failed attempt and a learning curve

- First attempt teaches discipline required for funded trading

- Second attempt has a far higher success probability

Newer traders developing consistency: Focus on skill first

- Build a reliable strategy before purchasing evaluations

- Your skill development timeline matters more than challenge speed

- Profitability in personal trading should come before paid evaluations

Why This Timeline Benefits You

This structured timeline isn’t arbitrary; it’s designed to identify traders who can manage capital responsibly. The evaluation process rewards disciplined trading, not gambling or luck.

Every requirement exists for a reason:

- Minimum trading days ensure consistency across multiple sessions

- Drawdown limits prove you can protect capital during losses

- Profit targets show you generate returns within reasonable risk

Your timeline to funding should prioritize sustainable success over speed. Rushing through minimum requirements often leads to rule violations that add weeks through retakes.

A measured approach that takes 3-4 weeks but succeeds on the first attempt beats three failed 1-week attempts.

If you approach your evaluation with patience and follow your proven strategy, you’re building the foundation for long-term success. Traders who maintain strong performance over time unlock scaling opportunities, growing from five-figure accounts to six-figure capital allocations.

Navigating evaluation timelines becomes easier with proper guidance.

Whether you’re tracking trading days, interpreting drawdown calculations, or preparing verification documents, having access to clear resources and responsive support helps you move through each phase efficiently.

Before You Click Purchase: The Readiness Checklist That Saves You Weeks

The fastest path to funding starts before you even buy a challenge. Most traders lose time and money by starting evaluations before they’re truly ready. The difference between a 2-week success story and a 3-month struggle often comes down to one question: Are you prepared?

This isn’t about discouraging you; it’s about protecting your investment and accelerating your actual timeline to funding. Taking an extra week to prepare properly can save you 4-8 weeks of failed attempts and wasted challenge fees.

The Five-Point Readiness Assessment

Run through this honest self-check before purchasing any evaluation:

1. Proven Profitability Over Time

Have you been consistently profitable on a demo or small live account for at least 2-3 months? Notice the word “consistently”; not just one good week or a lucky trade that rescued a bad month.

If you can’t honestly say yes, you’re not ready yet. The evaluation won’t suddenly make you profitable. It will only expose the gaps in your strategy under pressure with real money at stake.

2. Risk Management Is Already Your Default

Do you already use fixed risk per trade and respect stop losses without exception? Can you stick to 1-2% risk even when you’re confident about a trade?

Prop firm rules don’t teach discipline; they punish the lack of it. If risk management feels like a restriction rather than a habit, spend another month building that muscle memory before paying for a challenge.

3. Emotional Control Under Pressure

Can you go through 10-20 consecutive trades without revenge trading after a loss? Have you experienced a three-trade losing streak and still followed your plan on trade four?

The evaluation environment amplifies every emotional weakness. Traders who haven’t mastered their psychology in demo won’t suddenly find discipline when real challenge fees are on the line.

4. Strategy Behavior Across Market Conditions

Do you know how your strategy performs during high volatility? Have you tested it during major news releases? Can you identify when market conditions don’t suit your approach and simply not trade?

Many traders pass 80% of their evaluation, then lose everything during a single volatile session they should have sat out. Understanding when NOT to trade is as important as knowing when to enter.

5. Administrative Preparation

Are your KYC documents ready (clear ID photo, recent proof of address)? Is your payment method set up? Have you tested your trading platform and confirmed it works smoothly on your device?

These might seem minor, but scrambling for documents during verification can add 3-5 days to your timeline. Preparation accelerates every phase that follows.

What This Checklist Reveals

If you checked all five boxes confidently, you’re ready to start your evaluation with a realistic 2-4 week timeline to funding.

If you hesitated on 1-2 items: spend another 2-4 weeks strengthening those areas. This delay will actually speed up your overall timeline by preventing failed attempts.

If you couldn’t check 3+ boxes honestly, focus on building your foundation first. The evaluation isn’t going anywhere, but your capital and confidence are precious. Taking 1-2 months to develop real consistency will result in faster funding than starting unprepared and failing repeatedly.

Why This Matters for Your Timeline

Every failed evaluation attempt adds 2-4 weeks to your journey and costs another challenge fee. A trader who spends three weeks preparing properly and passes on their first attempt gets funded faster and cheaper than someone who starts immediately and fails twice.

The evaluation process is designed to reward traders who demonstrate discipline, consistency, and risk awareness, qualities you should already possess before clicking purchase. The challenge doesn’t build these skills; it reveals whether you have them.

This approach aligns with the core principle that talent and preparation matter more than rushing.

When you start an evaluation truly ready, your timeline becomes predictable, and your success probability dramatically increases. Take the time to prepare right, then execute with confidence.

Beyond Funding: Your Path from First Trade to Consistent Income

Getting funded is a milestone worth celebrating, but it’s just the beginning of your journey as a professional trader.

Understanding what happens in your first 90 days with funded capital helps you set realistic expectations and plan your progression from first payout to scaling opportunities.

The timeline from funded account to consistent income typically spans 3-6 months. Here’s what that journey actually looks like.

Your First Payout Timeline

Once you’re funded and start trading with capital, you become eligible for your first payout after a waiting period.

One thing you need to know before choosing your prop firm is that most of these companies require the aforementioned waiting period to pass to ensure you’re trading consistently and following all account rules in the live environment.

Key milestones:

- First payout eligibility: 14-30 days from your first funded trade

- Payout processing time: 1-7 business days after withdrawal request

- Realistic timeline to money in hand: 3-6 weeks post-funding

This waiting period isn’t arbitrary; it confirms that your evaluation performance wasn’t luck but reflects genuine trading skill. During these initial weeks, you’re proving the same discipline you demonstrated during evaluation, but now with real profit potential on the line.

Building Toward Scaling Opportunities

After your first successful payout, the next phase involves qualifying for larger capital allocations. Scaling means progressing to bigger account sizes, which directly increases your earning potential without requiring another full evaluation.

Scaling eligibility timeline:

- Opens up within 60-90 days of consistent funded trading

- Requires maintaining positive performance over 2-3 months

- Demands consistent rule compliance with no violations

- Looks for steady returns rather than volatile swings

Pro tip: Focus on consistency over aggressive profit targets during your first 60 days.

Firms prioritize traders who protect capital and show stability; these are the traders who get scaled first. A steady 3-4% monthly return with zero violations will advance your timeline faster than 10% gains mixed with rule breaches.

Multi-Account Progression Timeline

Traders who maintain strong performance often pursue managing multiple funded accounts simultaneously. This progression multiplies your earning potential while diversifying across different capital allocations.

Multi-account readiness:

- Typically realistic after 4-6 months of funded trading

- Requires a proven track record on your first funded account

- Demands demonstrated ability to manage larger capital responsibly

- Needs strong organizational skills to track multiple positions

The timeline extends to 4-6 months because firms want to see how you handle different market conditions, manage drawdowns, and maintain discipline over time, not just during favorable periods.

Think of it as building credibility: your first account proves you can trade, your second proves it wasn’t luck, and subsequent accounts prove you can scale systematically.

From Funded Trader to Consistent Income

The progression from “I have a funded account” to “I earn consistent monthly income from trading” takes longer than most expect. This isn’t a failure of the model; it’s the natural timeline for building a sustainable trading career.

Realistic income timeline:

- 3-6 months from initial funding to a consistent monthly income

- First 2-3 months: Learning to trade with larger capital

- Months 3-4: Adapting to managing your own simulated capital

- Months 5-6: Building track record that supports scaling opportunities

During these months, your evaluation investment begins paying real returns. Each successful month compounds your credibility and opens doors to larger opportunities. This period requires patience, but it’s when you transition from “passed an evaluation” to “professional funded trader.”

The 6-12 Month Career Trajectory

Reaching established, funded trader status takes time and consistent performance. At this stage, you’ve demonstrated long-term consistency, potentially scaled to larger accounts or multiple allocations, and developed a reliable income stream.

Career milestone timeline:

- 6-12 months from initial funding to “established” status

- Demonstrated consistency across multiple market conditions

- Successfully navigated drawdown periods without violations

- Built a reputation that attracts larger capital allocations

Important reality check: This trajectory isn’t about speed, it’s about building something sustainable.

Traders who rush this process by taking excessive risks often lose their funded status within 3-4 months. Those who approach it methodically, respecting both the opportunities and the rules, build careers that last years rather than months.

Understanding this progression helps you plan realistically and set appropriate expectations for your funded trading journey. Your funded account isn’t an instant income solution; it’s a professional opportunity that rewards patience and consistency over time.

Turning Timeline Awareness Into Evaluation Success

Your journey to funding becomes far more predictable when you understand what truly influences the timeline. Success comes from preparation, not speed; building consistency, strengthening risk discipline, and mastering your strategy before entering an evaluation.

When you focus on readiness rather than rushing, each phase becomes easier, cleaner, and more controlled.

Our Latest Stories

How to Get a Funded Forex Trading Account: Expert-Level Strategies for Realistic, Repeatable Success

The funded trading world is growing so fast that some firms now…

How to Choose the Right Prop Trading Firm: Expert Insights to Protect Your Capital and Sanity

The prop trading industry looks exciting at first glance, but choosing the…

Stay Informed,

Stay Ahead

Bookmark this blog to keep your edge sharp. Whether you're prepping for your first challenge or scaling into a six-figure funded account, our insights are here to help.