Prop firm challenges are structured to test consistency under constraints, not aggressive performance.

Many traders struggle not because their analysis is wrong, but because small execution decisions compound over time. Managing pace, exposure, and timing often matters more than individual trade outcomes.

This guide on passing the prop firm challenge focuses on aligning everyday trading decisions with evaluation conditions from the start.

Pass Prop Firm Challenges: Your 10-Step Execution Blueprint

Prop firm challenges are administered by proprietary trading firms to evaluate whether traders can follow strict risk and execution rules under real pressure.

While each prop trading firm defines its own drawdown limits, profit targets, and trading days, the execution mistakes that cause failure are remarkably consistent. That’s why the framework below focuses on decision-making discipline rather than firm-specific tactics.

Step 1: Decode Your Challenge Parameters Before Starting

Before placing a single trade, map out your challenge mathematically. Calculate your risk budget, daily profit requirements, and weekly milestones based on your evaluation rules.

Calculate these four critical metrics:

- Required daily profit: Divide profit target by minimum trading days, add 20% buffer

- Maximum risk per trade: Daily loss limit ÷ 4 (creates safety margin)

- Position size ceiling: Account balance × 1.5% ÷ stop-loss distance

- Weekly milestones: Break profit target into 3-4 week segments

Example for $100k Account: With an 8% target ($8,000) and 4% daily loss limit ($4,000) over 20 days: Daily baseline is $400/day, but risk only $1,000/day (25% of the $4k limit). If risking 1% per trade ($1,000), you can take 3-4 trades daily. Weekly targets: $2,000 | $2,500 | $2,000 | $1,500.

Pro Tip: Traders who plan mathematically before starting have significantly higher pass rates than those who approach challenges without preparation.

Step 2: Lock In ONE Trading Strategy (No Changes Allowed)

Choose your challenge weapon based on proven performance, then commit completely. Strategy-hopping mid-challenge resets your edge and is one of the fastest paths to failure.

Three High-Probability Options:

- Trend Following: Entry when price breaks 20 EMA with RSI confirmation, exit at 2:1 minimum

- Breakout Strategy: Entry when price breaks key levels with volume, target the next major level

- Reversal Strategy: Entry on strong rejection patterns, exit at 1.5:1 minimum

Validation Requirements: Backtest minimum 100 trades showing 1.5:1+ risk-reward, 45%+ win rate, maximum 5 consecutive losses, and demo test 20-30 trades in simulated conditions.

Critical Warning: If your worst 10-trade sequence shows a drawdown exceeding 60% of the daily loss limit, refine your strategy before purchasing any challenge.

Step 3: Build Your Challenge Trading Plan Document

Create a written trading plan covering every decision point before you begin. This eliminates decision fatigue and keeps you disciplined under pressure.

Essential Elements:

- Trading Schedule: Define exact hours (e.g., “8:00 am-11:30 am EST London/NY overlap”)

- Risk Parameters: Daily profit target (30-50% of weekly average), daily loss circuit breaker (60-70% of the firm’s limit), max 3-4 trades per day initially

- Instrument Selection: Choose only 3-5 instruments to reduce analysis paralysis

- Pre-Trade Checklist: Verify 5-7 criteria before every entry (trend alignment, risk-reward 1.5:1+, no news within 1 hour, position size calculated, total risk under 3%)

Template Example: “I trade EUR/USD and GBP/USD during 8-11:30 am EST overlap. Maximum 3 trades daily. Stop at +$600 profit or -$400 loss. Only enter when 5+ checklist items align.”

Step 4: Execute Conservative Week 1 (Foundation Building)

Your first week objective: prove your system works under pressure and build psychological capital. This isn’t about maximizing profits; it’s about establishing confidence.

Week 1 Strategy:

- Position Sizing: Trade 40-50% of calculated maximum size (if max is 2 lots, trade 0.8-1.0 lots)

- Trade Selection: Take only A+ setups where all criteria align perfectly

- Daily Target: Aim for 0.3-0.5% profit per day, weekly goal of 2-3% total

- Success Metric: End positive with zero rule violations

Emergency Protocol: If week 1 goes negative, stop trading on Friday, review all trades, identify patterns (overtrading, wrong conditions, emotions), and demo test 3-5 more days before resuming.

Step 5: Apply Surgical Risk Management Daily

Risk management separates funded traders from those who blow challenges. Every position requires mathematical precision; no guessing, no exceptions.

Position Size Formula:

Position Size = (Account Balance × Risk %) ÷ Stop Loss Distance

Example: $100k account, 0.75% risk ($750), 50-pip stop = $15 per pip (1.5 lots)

Non-Negotiable Rules:

- Place stop-loss immediately upon entry (zero exceptions)

- Move to breakeven at 1:1 risk-reward

- Stop trading if approaching 60% of the daily loss limit

- Never risk more than 3-4% total across all open positions

- Never adjust the stop further from the entry point

Critical Violations: Trading 15 minutes before/after high-impact news, removing stop-loss after entry, and holding over the weekend without permission.

Step 6: Document Every Trade in Real-Time Journal

Trade journaling is the feedback loop that turns mistakes into improvements. Traders who maintain detailed journals consistently show better performance and faster skill development.

Mandatory Fields Per Trade:

- Date/time, instrument, and setup type

- Entry reason with market context

- Position size and risk-reward ratio

- Emotional state (confident, anxious, revenge urge)

- Outcome (profit/loss amount and percentage)

Review Schedule:

- Daily (10 minutes): What worked, what violated the plan, pattern recognition

- Weekly (30 minutes): Calculate win rate, compare average winner vs loser, identify top 3 mistakes

Tools: Edgewonk, TradeZella, Google Sheets, or screenshot folders. Your journal reveals the recurring mistakes accounting for the majority of your losses.

Step 7: Adjust Strategy Based on Progress Checkpoints

Your strategy should evolve based on the position relative to the profit target. Week 3 is the critical assessment point for determining whether to protect, maintain, or push.

Three Scenarios:

Scenario A – Ahead of Target: If >60% complete with >40% days left, reduce position size by 25-30%, raise trade selection bar to A++, and lower daily target to 0.2-0.3%. Focus on capital preservation.

Scenario B – On Track: If within 15% of projected pace, change nothing. Maintain position sizing and trade frequency. Mental trap: “I’m doing well, so I can risk more” frequently leads to unnecessary failures.

Scenario C – Behind Target: If need >2× daily average with <30% days left, extend trading hours, accept B+ setups, and increase size by a maximum of 15-20%. DON’T: Increase 50%+, remove stops, revenge trade, or switch strategies.

Realistic Assessment: If needed, 3× daily average with <20% days left, the passing probability becomes very low. Consider restarting fresh.

Step 8: Navigate Final Week with Precision

The final week requires surgical execution based on mathematical assessment. Calculate exact requirements, then choose the appropriate strategy.

Calculate Requirements:

Remaining Profit = Target – Current Profit

Daily Need = Remaining Profit ÷ Days Left

Decision Matrix:

- Need <30% of average: Ultra-conservative approach, reduce size to 50%, take only the safest setups

- Need 30-60% of average: Maintain approach, slight hour extension, increase size by a maximum of 15-20%

- Need >60% of average: Focus on the highest-probability setups only, accept uncertainty

Final 48 Hours: If within $500-1,000 of target, shift to micro-lot grinding with 0.2% risk trades and 10-15 pip stops to scratch out final profit safely.

Step 9: Master Critical Rule Compliance

Rule violations cause instant failures regardless of profit. Most violations stem from complacency, not ignorance; traders know the rules but fail to verify before each trade.

Pre-Trade Verification (Verbal Confirmation):

✓ Trade allowed under firm rules

✓ Total risk under maximum

✓ No high-impact news within restricted timeframe (if applicable to your program)

✓ Minimum trading days covered with buffer

✓ Position holding aligns with your challenge type

Protective Alerts:

- Drawdown warning at 85% of threshold

- Daily loss alert at 70% of maximum

- News notifications 30 minutes before major events

Zero Tolerance Triggers: Exceeding maximum drawdown limits, violating daily loss limits, failing to meet minimum trading days, and using unauthorized account management services.

Step 10: Transition Successfully to Phase 2 (Two-Step Challenges)

Passing Phase 1 doesn’t guarantee Phase 2 success; overconfidence causes most Phase 2 failures. Traders who pass Phase 1 have a strong Phase 2 pass rate IF they maintain exact discipline.

Post-Phase 1 Protocol:

- Take a mandatory 2-3 day break before starting Phase 2

- Review all trades, identify 3 best setups and 3 worst mistakes

- Reset psychology: Lower target doesn’t mean easier

Phase 2 Execution:

- Week 1: Reset to 50% position sizing, target 0.3-0.5% daily profit

- Week 2-3: Gradually increase to 75% size, target 0.5-0.75% daily

- Maintain the same selection standards (no relaxing)

Common Failures: “Phase 2 will be easy” leads to careless trading, rushing causes rule violations, and unnecessary risks violate limits despite being ahead.

Success Formula: Treat Phase 2 exactly like Phase 1 Week 1; prove yourself from scratch.

Following this 10-step framework gives you a structured, disciplined approach to passing evaluations and earning your funded account.

Match Your Trading Style to Your Challenge Path (And Avoid Mismatched Struggles)

Choosing the wrong challenge type is one of the fastest ways to fail, even with solid trading skills. Day traders forced into swing-trading rules struggle unnecessarily, and swing traders constrained by intraday-only requirements face the same frustration. The challenge structure should work with your natural trading rhythm, not against it.

When your evaluation aligns with how you already trade, you eliminate friction and focus purely on disciplined execution. The goal isn’t finding the “easiest” challenge; it’s finding the one that lets you demonstrate your strengths without fighting mismatched rules.

For Active Intraday Traders (Scalpers & Day Traders)

If you thrive on multiple trades per session and close all positions before market close, you need flexibility for high-frequency execution.

What you need:

- Programs allowing same-day position management without forced overnight holds

- Core-style evaluation paths designed for intraday trading rhythms

- Platforms built for fast execution and scalping strategies

Best evaluation match: Instant Funding, 1-Step, 2-Step, or 3-Step evaluations with Core variations that maintain intraday freedom while offering path flexibility based on your preparation level.

For Swing and Position Traders (Multi-Day Holds)

If your strategy requires holding positions across multiple sessions or weekends to capture larger moves, you need holding flexibility.

What you need:

- Programs allowing multi-day and weekend holds without forced closure

- Flex-style evaluation paths accommodating extended position management

- Trailing drawdown structures supporting overnight positions

What to prioritize: Instant Funding, 1-Step, 2-Step, or 3-Step evaluations with Flex variations that support swing approaches through trailing or instant-trailing drawdown options accommodating multi-day positions.

For Conservative Risk Managers (Steady & Consistent)

If you prioritize capital preservation over aggressive profit-taking and prefer predictable risk parameters, you need evaluation structures that reward consistency.

What you need:

- Programs with static drawdown for predictable risk tracking (threshold never changes)

- Lower daily pressure through extended evaluation windows

- Challenge structures valuing steady performance over aggressive returns

Program features to seek: Static drawdown programs across 1-Step, 2-Step, or 3-Step evaluations that provide fixed risk parameters never trailing or adjusting, perfect for methodical traders wanting predictable risk management.

For Experienced Traders Ready for Immediate Action

If you have proven consistency and want to skip multi-phase evaluations entirely, instant funding provides immediate capital access.

What you need:

- Instant funding programs eliminate waiting periods between phases

- Acceptance of real-time performance monitoring from day one

- Confidence performing under live conditions without practice phases

Optimal challenge type: Instant-trailing evaluation programs providing immediate funding for traders ready to demonstrate discipline from the first trade, completely skipping traditional phase structures.

The right challenge lets you trade naturally while demonstrating disciplined, rule-based execution that qualifies you for funded capital.

Qualification Happens When Execution Never Breaks

Passing a prop firm challenge isn’t about guessing the market; it’s about consistently making the right decisions under structured risk and rule constraints.

When your execution process stays intact from trade one through to the final day, you remove the emotion that causes most failures and let disciplined risk management guide your progress. Focus on preserving capital, following constraints, and executing trades exactly as planned.

If you’re ready to apply this disciplined approach and take on real challenge conditions, start your journey with Eleonex and put your execution framework to work in a structured, fair evaluation environment.

Our Latest Stories

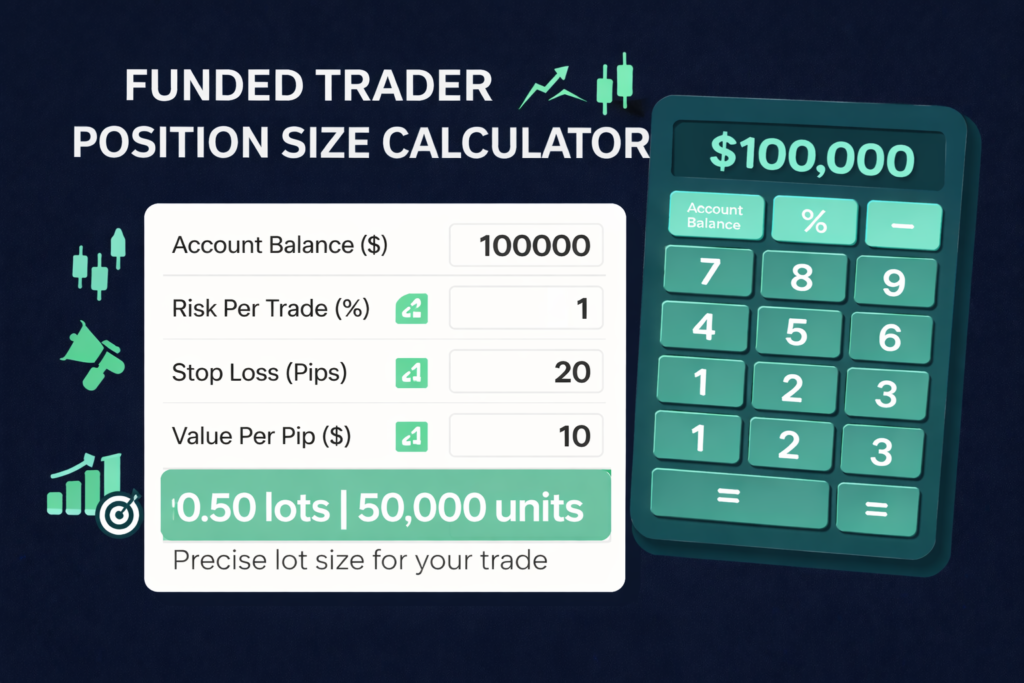

Funded Trader Position Size Calculator: Turn Risk Per Trade Into Exact Lots in Seconds

Position sizing isn’t just another trading calculation; it’s the math that determines…

Funded Trader Maximum Daily Drawdown Calculator: Know Your Breach Point Before the Market Tests You

Managing your daily drawdown is the difference between staying funded and losing…

How To Get A Funded Gold Trading Account: A Clear Path for Trading Gold Without Personal Capital

Gold is one of the most actively traded assets in the world,…

Stay Informed,

Stay Ahead

Bookmark this blog to keep your edge sharp. Whether you're prepping for your first challenge or scaling into a six-figure funded account, our insights are here to help.